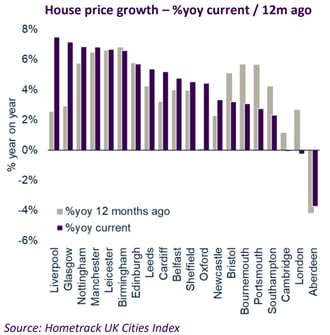

The latest Hometrack Cities Index for August is out and shows that house price growth across the UK’s 20 major cities is currently running at 3.2%.

Liverpool is the fastest growing city up 7.5% in the last year, joined by Glasgow (7.2%), Nottingham (6.9%), Manchester (6.8%) and Leicester (6.7%).

Cambridge (-0.1%) and London (-0.3%) have both seen marginal decreases on an annual basis as wider market uncertainty continues to impact the higher end of the property market.

Despite the lower average price of £164,800, wider economic issues in Aberdeen have resulted in a further fall in house prices of -3.7% - the only other city to see a negative movement in prices.

The continued increase in property prices in the nation’s major cities means that the income to buy deficit has grown by 18% since 2015, even with the low affordability of mortgages that buyers have enjoyed for quite some time now.

While current market uncertainty has slowed the market in some areas of the UK, there are a number of regional cities that continue to defy wider market trends.

Looking ahead, the possibility of a no deal Brexit is causing an air of uncertainty to remain hanging over the property market. This could have a notable impact on the economy and the UK property market, particularly if we see an increase in interest rates which could come as early as November.

This is what our CEO and Growth Expert Andy Soloman had to say...

There’s every chance a no deal Brexit will have a substantial impact on the economy, but until this comes to fruition we can only predict the extent of said impact.

Until then, the property market in the UK’s major cities will remain fairly robust and prices will continue to climb, driven by low interest rates and an imbalance between supply and demand.

While the fog of market uncertainty still hangs over London, the latest figures also demonstrate the drastic regionalities in the current UK market and the difference in performance from one city to the next. Despite the increasing gap between wages and prices, there is still plenty of scope for these more affordable cities to see continued property price growth.